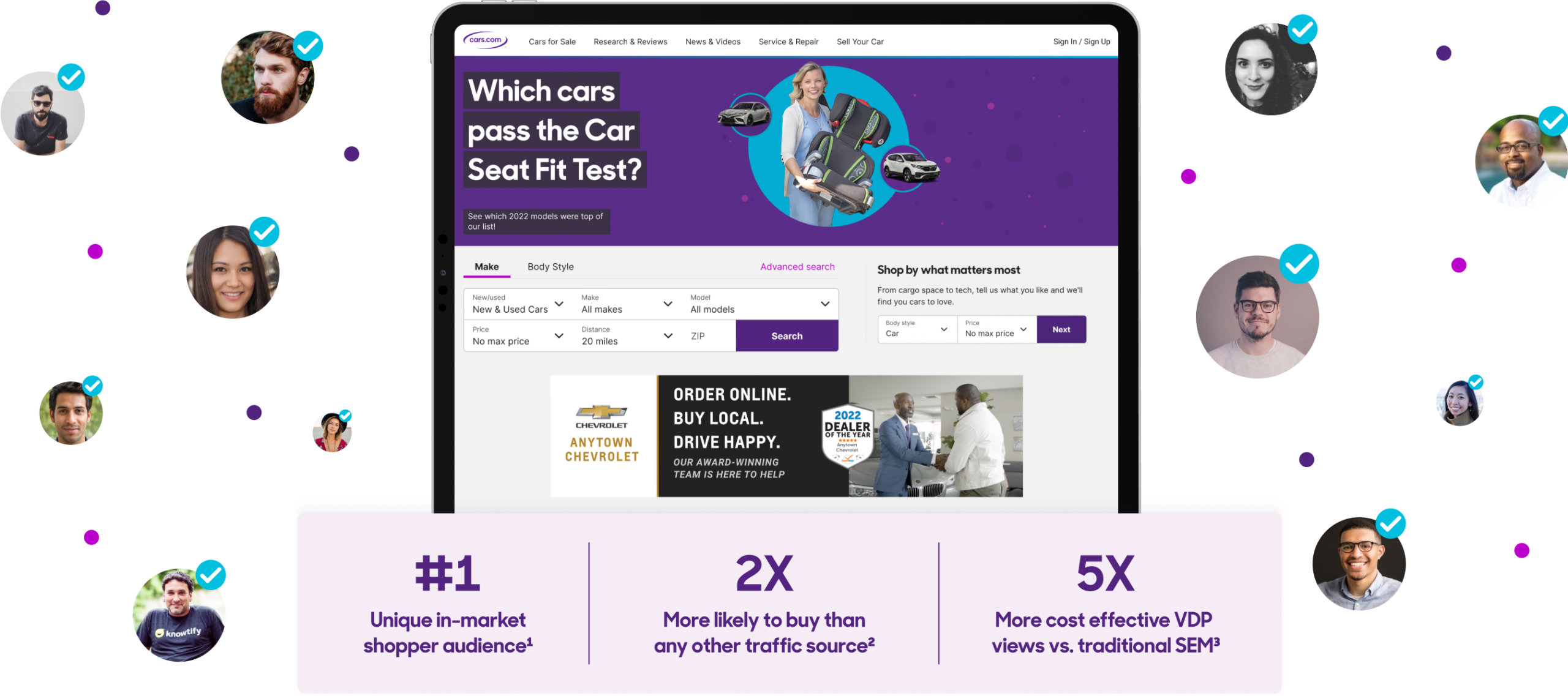

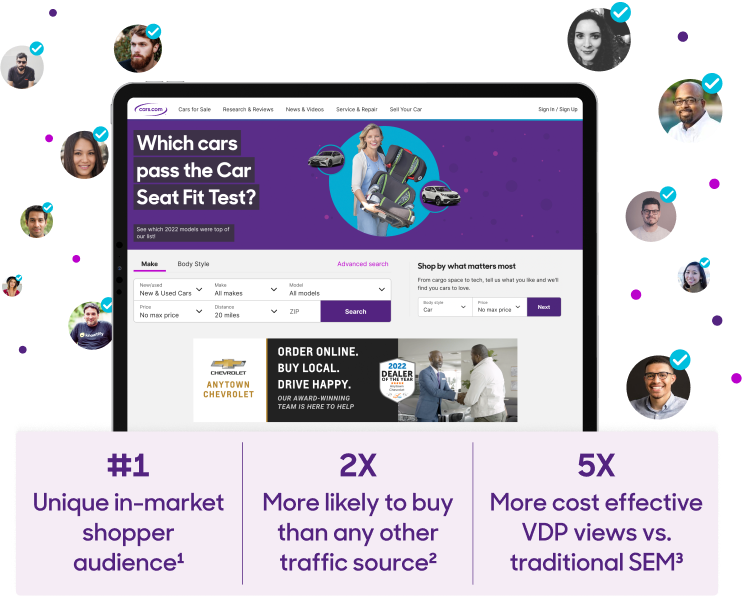

Maximize ROI on the #1 marketplace

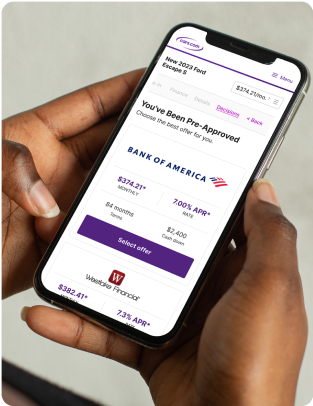

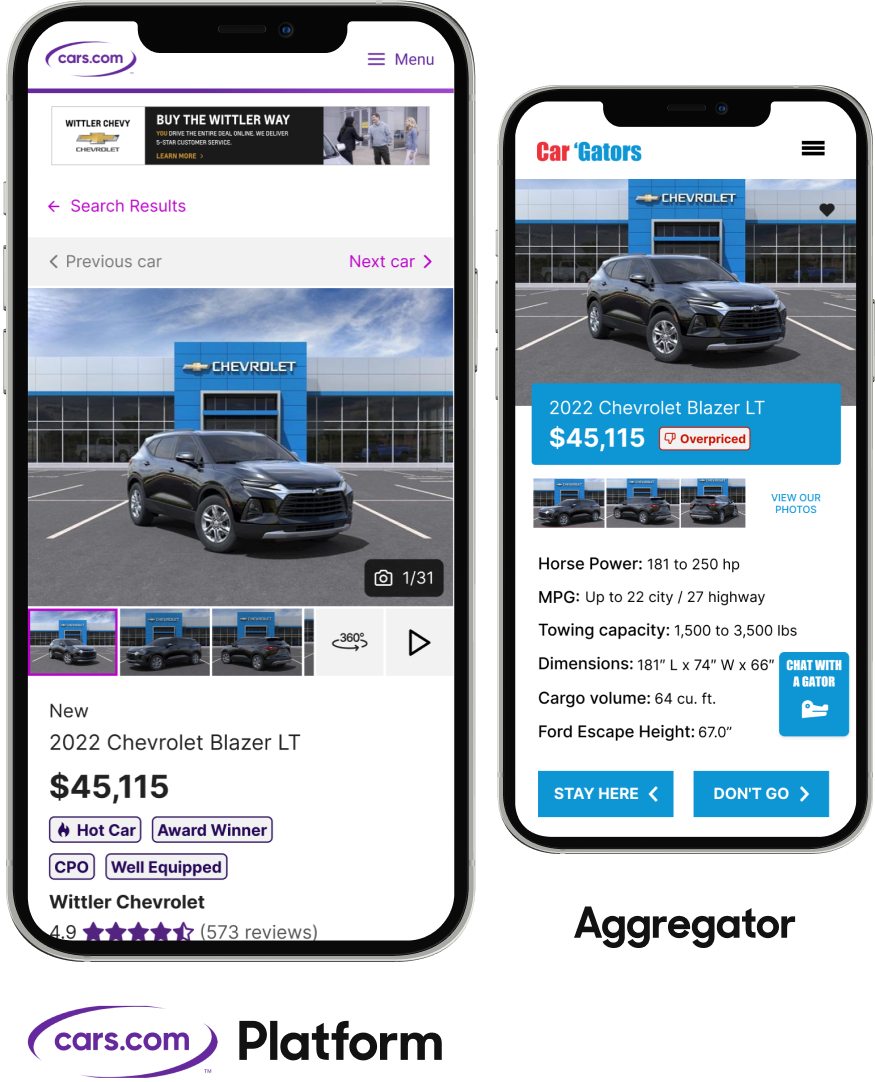

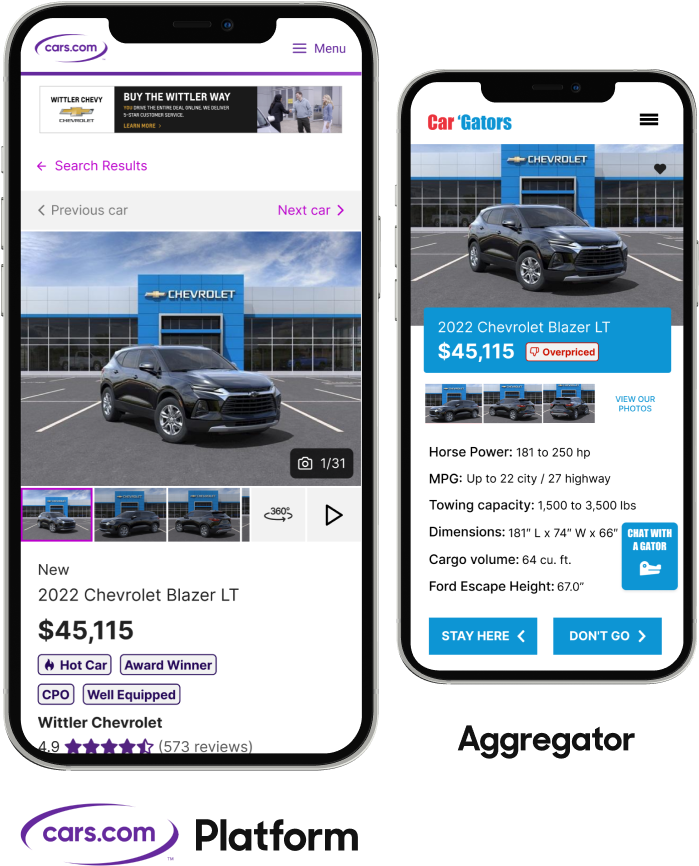

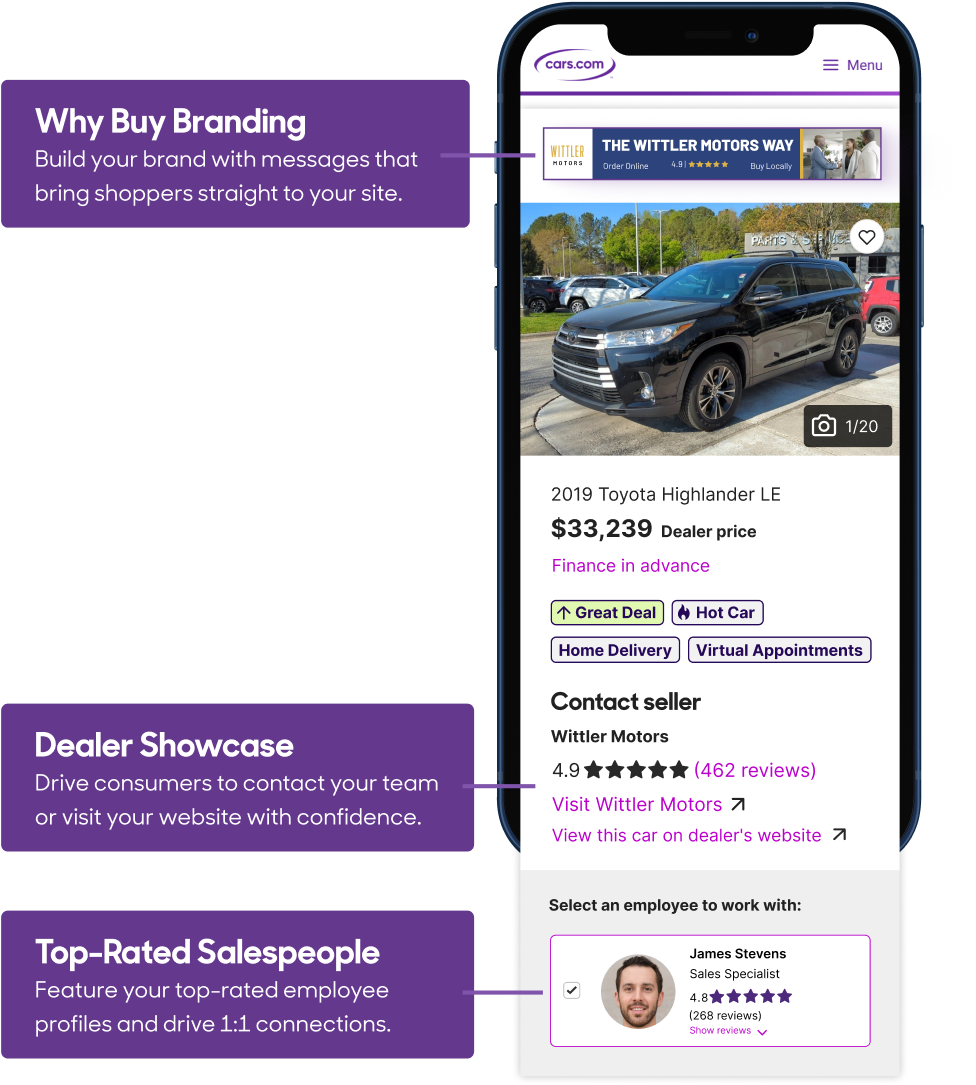

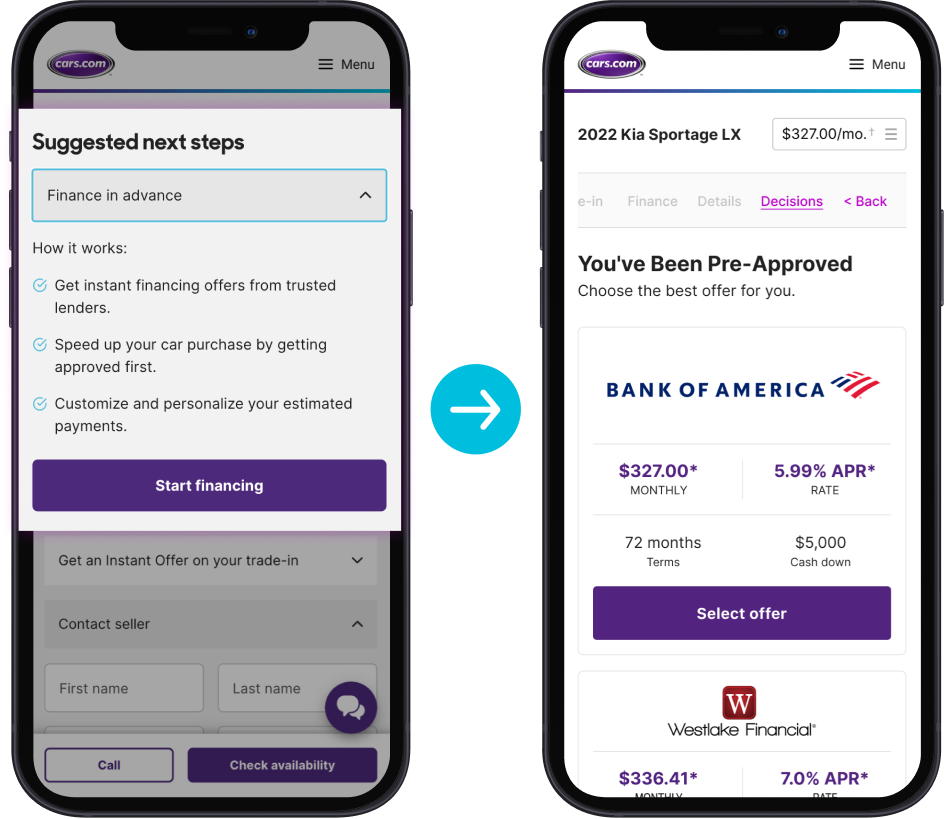

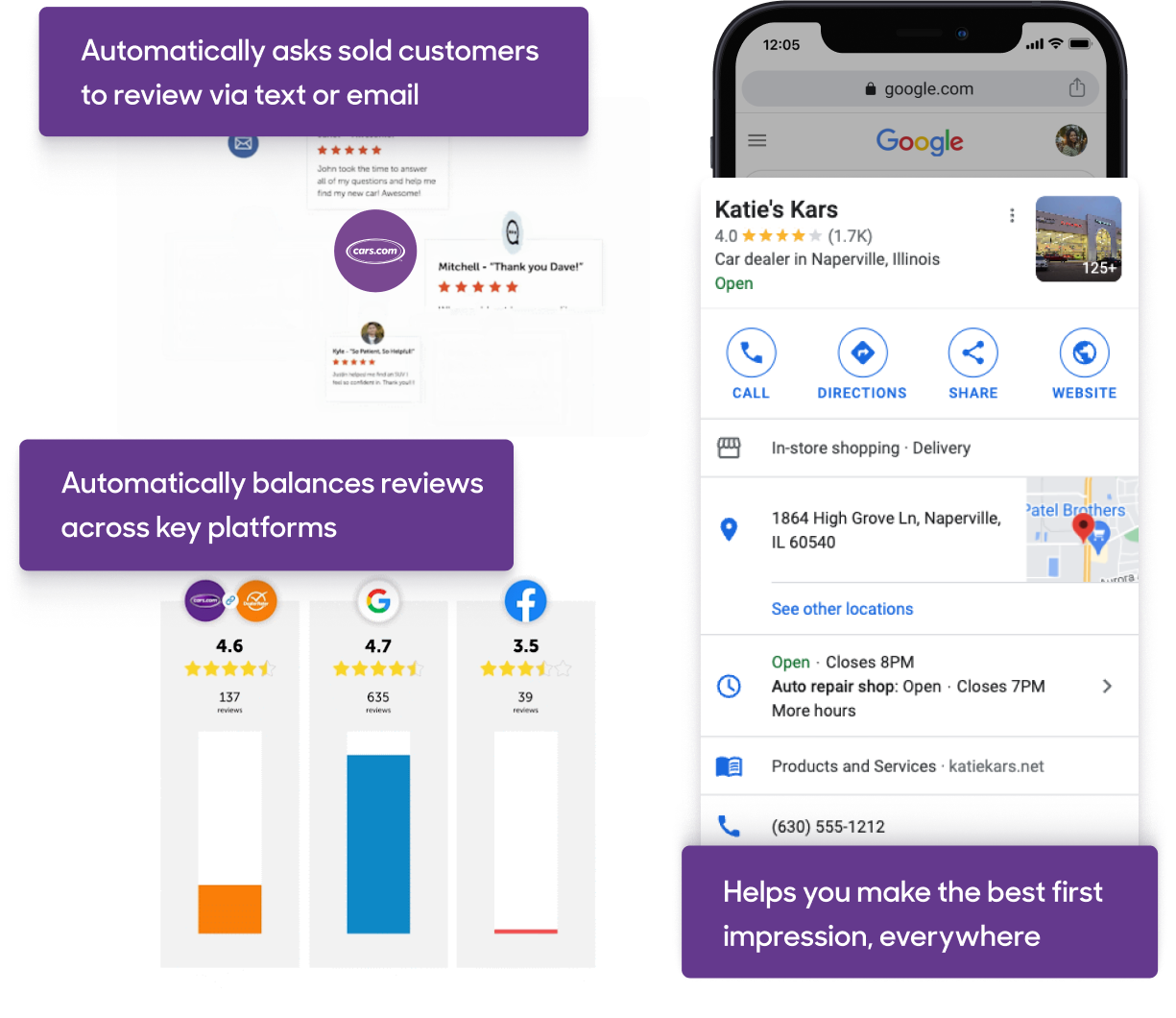

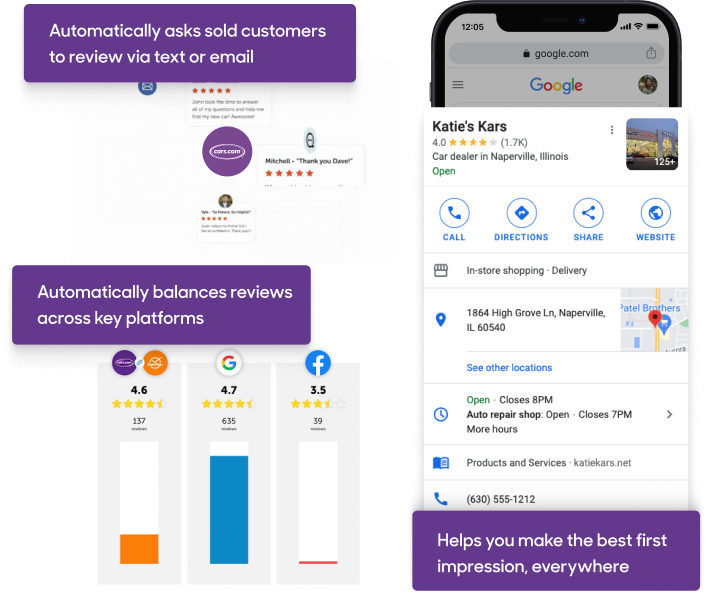

While advertising becomes increasingly inefficient at reaching real car buyers, Cars.com gives your business the platform to meet consumers you know are actively shopping — and impress them with the full value of your inventory, team, and customer experience.